13 Jan Hydrocarbons in Bolivia: Taxes and Royalties vs. Subsidies

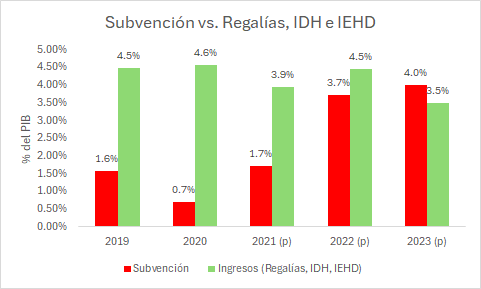

The year 2022 marked a critical turning point for Bolivia’s hydrocarbon sector, as import values exceeded export revenues for the first time. In 2023, another significant shift occurred: subsidies for gasoline and diesel surpassed the combined revenues from royalties, the Direct Tax on Hydrocarbons (IDH), and the Special Tax on Hydrocarbons and Derivatives (IEHD).

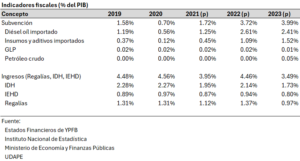

The following table presents the breakdown of both subsidies and revenues in the hydrocarbon sector, expressed as a percentage of GDP. For instance, in 2019, subsidies amounted to 1.58% of GDP, while revenues from royalties, IDH, and IEHD totaled 4.48%, resulting in a positive net balance. However, by 2023, the figures turned negative, with subsidies rising to 3.99% of GDP and revenues falling to 3.49%. As noted earlier, this marks a new inflection point.

Unless natural gas production stabilizes and subsidies are curtailed, these fiscal imbalances will likely deepen. The challenge for the next president, whoever that may be, is clear: to reverse this trajectory and restore fiscal sustainability.

May 2025 bring peace and good health to you and your family. As our republic reaches its 200th anniversary, it offers a fitting moment to reflect on our successes and mistakes, to learn from history, and to face the future with renewed hope.

Warm regards,

S. Mauricio Medinaceli Monrroy

Bogotá

January 13, 2025

No Comments